| dc.description.abstract | Summary

This thesis is based on the “BØK” courses and “ELE3750 Finansiell Analyse og

Verdsettelse”.

Our strategic analysis regarding the Birken Group shows that most external factors

tend towards favorable trends for the organization. However, consumer’s demand for

competitive outdoor sport events may decrease. Our internal analysis shows that the

Birken Group has several factors that give them a potential sustainable competitive

advantage, but the cost structure prevents them from achieving this.

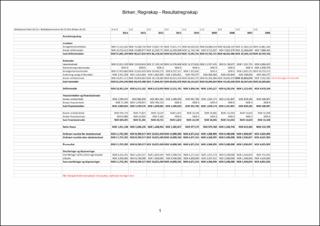

In the financial analysis we see that the net profit margin is decreasing, despite the

fact that revenue has tripled over the last 9 years. This is once again due to rapidly

increasing costs, which has increase over 5 times in 9 years. The Birken Group has a

very low liquidity risk, mainly due to a large cash reserve of approximately 60

million NOK. We also see a plummet in the free cash flow to equity due to a 20

million NOK decrease in the short-term debt item payment in advance.

We therefore advice for the Birken Group to reduce the rampant growth of costs and

invest parts of the cash reserve to get a higher rate of return on their excess cash,

while still maintaining a healthy cash buffer. We also recommend that the Birken

Group reduce their dividend payout while their net working capital is fluctuating

heavily, which it has for the last few years. | en_US |