| dc.description.abstract | Empirical evidences documented many links between firm characteristics with

stock returns. Even with the Fama-French three factor model in 1992, there are still

a lot of abnormal returns cannot be explained by CAPM model or Fama-French

model (Fama and French, 2009). While when researchers are focusing on specific

financial proxies to explain the return, there are other researches that developed

intuitively from the macro-economic, and in theory with appropriate proxy and

estimation method, the empirical evidence can be found the micro-economic level.

The Investment CAPM is one of these theories, instead of using the equilibrium

condition from the relationship between supply and demand, it pursues the asset

pricing from a different perspective than the behavioural finance.

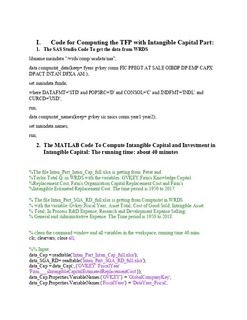

Total Factor Productivity (TFP), on the other hand, is developed from macroeconomic

level for explain the growth of the country’s GDP and defined as “the

portion of output not explained by the amount of inputs used in production” (Diego

Comin, 2006). Unlike the Investment CAPM, productivity is the key source for

economic growth and productivity growth is the key economic indicator of

innovation.

Economic growth can take place without innovation through replication of the

established technologies (Jorgenson, 2009). While there are empirical evident about

the link between the firm-level TFP and the stock returns, the traditional firm-level

TFP focuses on the physical capital and labour. However, firms are investing big

amounts into intangible assets such as R&D, software, brands …etc “at a rate close

to that of tangible assets” (Ellen R. McGrattan, 2017). Therefore, in this study, we

incorporate the intangible capital and the investment in intangible capital into the

firm-level TFP measurement.

This paper provides the evidences about the link between this new firm-level TFP

with intangible capital and stock return. Chapter 2 is the literature review for the

development of the TFP theory and the relevant estimation methods. Chapter 3 is the data collection and estimation method. Chapter 4 is the data analysis and the

robustness check. Chapter 5 is the conclusion. | nb_NO |